Last week, ClickZ attended the eTail Europe conference in London, catching up with the best and brightest in eCommerce – including top brands, technology vendors and research academics.

The event was a huge success, with highly-qualified speakers breaking down cutting-edge issues in the industry, and providing expert insight and analysis. Of particular interest was a panel discussing the challenges associated with connecting online and offline experiences in store.

The panel was made up of senior marketers from primarily European brands, including:

- James Williamson – Digital Brand Marketing Manager at Heal’s (a high-end homeware store)

- Lina Kehlenbeck – Senior Product Owner, Online & Retail Operations at Sainsbury’s (a major UK grocery store)

- Maxime Taieb – Head of Solutions & Innovation at Carrefour (a French grocery store with ~20% market share)

- Philip Ward – Head of Digital Experience & Development at Carphone Warehouse (a UK-based electronics retailer)

Connecting online and offline

Amazon’s recent acquisition of Whole Foods framed the discussion and made the importance of an eCommerce strategy for a brick-and-mortar store a natural starting point. This is a problem of particular relevance to grocery stores. The fact that 92% of US customers still prefer to purchase their groceries in-person could be interpreted in two ways: either this is an untapped market ripe for Amazon-style digital disruption, or it shows consumers’ unwillingness to relinquish the touch-and-feel experience of purchasing groceries.

The panel seemed to fall somewhere between the two. Maxime Taieb of Carrefour immediately acknowledged the necessity of an online proposition to traditional grocery stores, but qualified it by pointing out that “there is no ecommerce in a traditional store”. It seems at heart, the customer journey for grocery shoppers is still tied to the brick-and-mortar store.

Lina Kehlenbeck of Sainsbury’s agreed, but said the ultimate goal for brands like hers was “to bring the “Amazon” convenience to the physical store”, citing click-and-collect, deliver-to-home and drive-through grocery shopping as examples of digital initiatives helping to drive sales in a brick-and-mortar environment.

However, she was skeptical about the prospect of a fully-digital customer journey for grocery shopping: “Ultimately…I want to feel my own avocados before I buy them.”

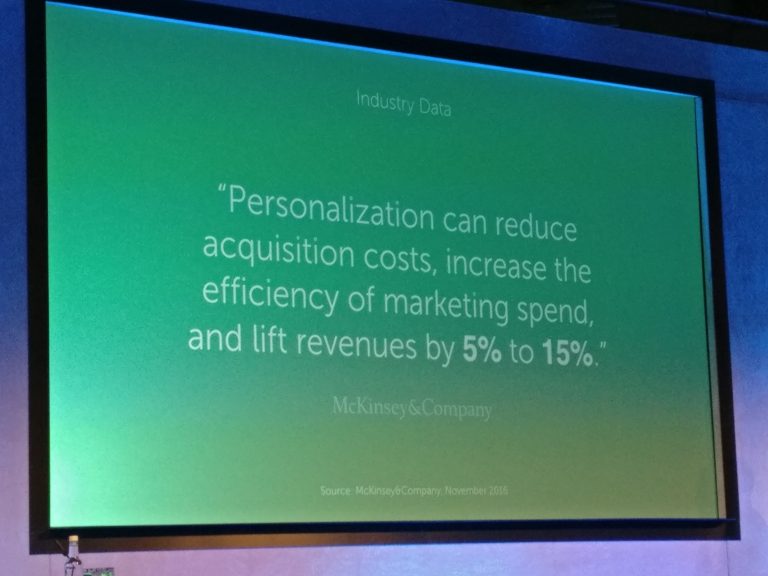

This was echoed by the other participants, who both felt there was great potential for digital to assist the in-store experience, but not to replace it. Philip Ward from Carphone Warehouse talked about using the website to help foster better conversations with salespeople in-store, and to cut down time spent clarifying customer needs. One example he cited was making customer profiles accessible to salespeople via tablets, which he said helps deliver a connected online-to-offline experience for customers.

James Williamson of Heal’s mentioned a similar scheme whereby website users could be connected to the most relevant salesperson for their query, who could also act as an in-store point of contact. This helped to personalize each customer’s shopping experience – ideal for a brand targeting high-end consumers.

Innovative technology

The panel moved on to discuss their implementation of new technologies to support their digital strategies. Kehlenbeck spoke about the importance of data collection through the Sainsbury’s Nectar Card, which allows the retailer to tailor product offers based on individuals’ purchase history.

The introduction of bluetooth beacons has allowed Sainsbury’s to take this a step further, delivering targeted push notifications to users based on their in-store location. “This lets us deliver deals at the point of decision,” said Kehlenbeck.

Taieb, representing the rival grocery store on the panel, revealed that the same technique simply hadn’t been effective for Carrefour – particularly around push notifications:

“The feedback we got from customers was ‘leave me alone’. They are there already…they don’t need to hear from us.”

However, he also highlighted the scope for improving in-store efficiency by, for example, digitizing the checkout process and allowing customers to pay with their phones. Following up after customers left the store was also important:

“The e-commerce proposition should be an extension of the physical store…it’s what happened after the store that was key.”

Williamson (Heal’s) agreed, citing a simple automated email, sent out to customers after an in-store interaction (which captured both their email address and their intent) which drove a 9% increase in order value for the homeware retailer.

Key takeaways

Overall, the main lessons and overarching themes from the discussion were:

- The customer experience of brick-and-mortar stores won’t change drastically, but what happens either side of that experience will

- The jury is out on grocery stores: some think consumers will always want tangibility when buying food, others think total digital transformation is only a matter of time

- Convenience is king – online channels will help smooth offline experiences.

Source: ClickZ