Online retail basks in ‘stay-at-home’ shopping surge

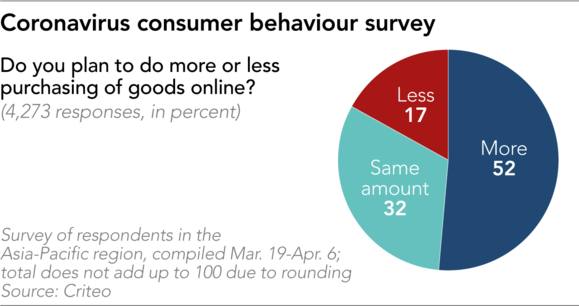

E-commerce retailers across Asia have seen explosive sales growth during the pandemic crisis as consumers under lockdown splurge online.With brick-and-mortar retail outlets virtually shut out of the market, government enforced lockdowns have also provided an unexpected boost for niche e-commerce platforms that consumers may never have visited otherwise.Digital advertising solutions provider Criteo said its market research indicated that more than 50% of consumers now had more plans to shop online as a result of the pandemic, compared to just 17% who said they would now make few digital purchases.

“We have seen increased demand for health and personal hygiene products including surgical masks and hand sanitizers, along with other daily necessities such as nonperishable food and beverage products,” said Zhou Junjie, chief commercial officer for Singapore-based e-commerce platform Shopee.

Shopee has reaped the benefits of the pandemic, with its gross merchandise value jumping 74.3% to reach $6.2 billion for the first quarter.

The total number of orders on Shopee reached 429.8 million in the first quarter, compared 203.5 million for the same period last year — an increase of 111.2%.

Jumping on the surge, Shopee, which is one of Southeast Asia’s largest e-commerce platforms by web traffic, has rolled out a program for consumers to buy items for cooking, work and entertainment — with free shipping to boot.

Its parent company Sea Group this month said it was eyeing business expansion and potential acquisitions with proceeds raised from a $1-billion convertible note offering due 2025.

“The coronavirus situation has materially accelerated a shift to online lifestyles that is broad, deep, and we believe, irreversible,” Shopee’s Zhou said. Industry players have been quick to conjure up campaigns to capture this shift, and to reverse the general slowdown in consumption worldwide.

Singapore’s CapitaLand, one of Asia’s largest real estate groups announced last week that it will be introducing a new e-commerce platform named eCapitaMall featuring the wares of retailers that had physical shops in the company’s malls.

“As the operator of Singapore’s largest mall network, we want to help our retailers reach out to more consumers and online business opportunities,” Chris Chong, Managing Director for Retail at CapitaLand Singapore said.

In China, e-commerce platforms took part in a new shopping festival, anchored in Shanghai, named “Double Five” — after the 5 May date of its launch. The event raked in US$2.2 billion in the first 24 hours, according to the Chinese financial hub’s Commerce Commission.

Billions of renminbi in the form of online coupons and discounts were distributed for the campaign, which has been slated to last for two months with digital retailers even teaming up with offline shops to hawk big ticket items like luxury cars for sale.

U.S.-based investment management firm Invesco noted that in China, online retail penetration reached 28.2% in the first quarter of 2020, up from 23% in the same period last year; as Chinese authorities enforced lockdown measures to slow the rate of coronavirus infections.

“E-retailers will likely continue to gain share in the retail market. We believe there will be more emphasis in developing and refining their interactions with customers to ensure more sales can be effectively done online,” William Yuen, Invesco’s Investment Director told Nikkei.

The challenges players faced revolved around fulfilling deliveries as the surge in online shopping for essentials met with a logistics crunch as the pandemic disrupted international supply chains when parts of economies across countries shutdown to keep the virus at bay.

“We see companies have worked on the back of government advices and had to remodel how goods are delivered from the warehouse to end customers,” Yuen said.

Arne Jeroschewski, Co-Founder of package tracking service provider Parcel Perform, said at a webinar on the pandemic’s impact on tech companies that some warehouses have had to shut as workers developed COVID-19 symptoms, leading to logistical downtime which further compounded supply chain issues.

“There is an inventory mismatch. Not everyone is buying the same things that they were buying before. So a lot of in-demand categories are out of stock and it wasn’t entirely working to restock those items fast,” he explained.

While e-commerce as a business fell on the “right side” of circumstances brought on by the pandemic, Sachin Kapur, Senior Director of Marketing at Coupang, one of South Korea’s largest e-commerce players, said his firm has had to work harder to keep promises to customers.

“We created very detailed protocols across the organization, in terms of teams, in terms of logistics, in terms of cities to ensure that while we are keeping employee safety and hygiene on top priority, we are delivering as many packages as possible,” he said at another webinar which discussed how businesses were reacting to COVID-19.

Industry players have also teamed up to work around pandemic hurdles. Indonesian e-commerce unicorn Bukalapak has partnered with Grab and Gojek — ride-hailing rivals and makers of mobile ‘super apps’ which include delivery functions — to reach customers.

“We are having a lot of initiatives to actually increase our customer retention on that part, such as giving them a good coupon or good discount for the next purchase, and also giving (the option) to purchase with instant delivery,” Anugrah Mardi Honesty, Head of Display Marketing at Bukalapak said at the same webinar attended by Coupang.

Gojek said it saw 10% growth in transactions on its GoFood delivery service at the start of May compared to end-April, with some snack merchants on its platform seeing a 30% jump. It has added shopping services for food and staples from convenience stores to its offerings.

The decacorn has also partnered with Indonesia’s Agriculture Ministry to help more local farmers and market sellers, known as “Mitra Tani Markets” in the country, to migrate online and sell staple goods.

“Before COVID-19, we were selling about 1 to 1.5 tons of rice. Now during COVID-19, we actually experienced an increase in sales of 25% to 50% after Mitra Tani Market went online,” said Agus Widodo, a local vendor.

For Vietnamese e-commerce platform Sendo, the pandemic has prompted a search for tie-ups with partners beyond the country’s shores to expand the range of options for consumers who went online to shop.

“We also talk with the big multinational brands like Unilever or Procter & Gamble, and helping them setup a store on Sendo to deliver the essential products to our customers,” Duc Pham, Deputy Head of Marketing at the platform said at the webinar attended by Bukalapak and Coupang.

Clement Lee, Co-Founder at Singapore-based e-commerce enabler Synagie Corporation, said the pandemic has dramatically altered the habits and lifestyles of consumers, which he expected to remain as a legacy of the global health crisis.

He was speaking at the webinar attended by Parcel Perform: “People will work from home, and also shop from home, leading to immense opportunities in e-commerce, which every business must embrace.”

Looking to build customer loyalty through social media? Don’t forget to add your business to Top4.com.au

List your business, create your own digital store to sell goods and services, and share posts on social media. Promote your business on Google instantly! Should you need help with local digital marketing then view our new Google Marketing Platform and services Top4 Marketing

Get Found On Google Promote Your Website, Reach local customers today!

Our Digital Marketing Agency Services Across All Industries Include Search Engine Optimisation (SEO), Google Marketing, Website Design, Corporate Web Development, and local location-based marketing using our own Google Marketing Platform!

Engage A Social Media Agency For Only 1/3 The Cost Of Employing A Social Media Manager…LET’S TALK!

Source: asia.nikkei