If there is a silver lining to the Covid-19 pandemic and yearlong lockdowns, it might be that the financial planning industry has started to move “out of the stone age and into the digital age” in terms of marketing and communications, according to April Rudin, founder and president of The Rudin Group.

“Right now, the best platform I can think of is Zoom,” she said. “Having Zoom phone calls has done a lot to create deeper client relationships. Instead of just having the annual or quarterly meeting with clients, Zoom has given us all a chance to get to know people better and more deeply.”

Speaking Tuesday as the closing keynote speaker at the InvestmentNews Fintech Virtual Summit, Rudin said many of the experiences from the pandemic that prevented traditional marketing, networking and client prospecting efforts, opened advisers’ minds to new ways to use existing channels of communication.

Talking specifically about social media, Rudin listed LinkedIn, Facebook and Twitter, in that order as must-have accounts.

“There is no silver bullet, or one size-fits-all social media strategy, but LinkedIn is a no-brainer, because that’s where everyone has been spending a lot of time connecting with clients, prospects and centers of influence,” she said.

With that in mind, Rudin said, there is no time like the present to refresh your profile and headshot. And in terms of “beefing up your profile,” she encourages going beyond the basic statistics related to years of experience and assets under management.

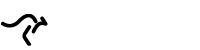

Here is how we help Salt Finance with Linkedin management to target people within their network. Alongside building trust as they can see their recommendations and connections and evidence of where they have added value.

“Pepper your profile with personal projects and details, causes you care about, hobbies, and where you grew up,” she said. “And take a look at your headshot. Whatever you’re looking like now, it’s a good time to update your headshot because clients are looking for advisers to be more authentic.”

In addition to having a fresh photo and engaging LinkedIn bio, Rudin said it is important to consider the quality and quantity of whatever you are posting.

“The world is not waiting for another adviser podcast or blog but making some short posts and sharing content related to your passion or practice is a good idea,” she said. “And if you make a post, pay attention to the people who are engaging with it.”

Because people generally spend more time checking news and social media first thing in the morning, Rudin said it is a good idea to “just choose something from your morning reading and posting it.” And you shouldn’t be too concerned about reposting later in the day because LinkedIn refreshes throughout the day, “so you don’t have to worry about over-posting.”

After LinkedIn, Rudin ranks Facebook as the next account advisers should have, but said if you’re not comfortable sharing too much personal information and posts with clients, it is okay to open a more professional company account on Facebook.

“In terms of being friends with clients on Facebook, it just depends on what you’re comfortable with,” she said. “But keep in mind, Facebook is full of information about weddings and births and all kinds of wealth events. It’s not just a platform for connecting with friends.”

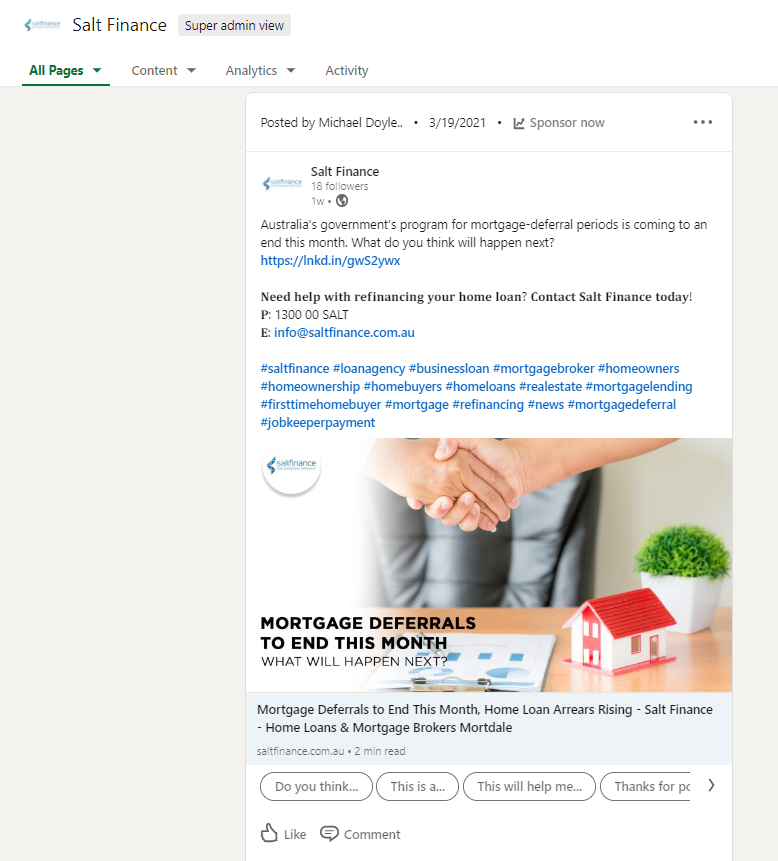

Below is another sample of how we help JCL Legal reaching more people on Facebook by doing regular posts on their Facebook account.

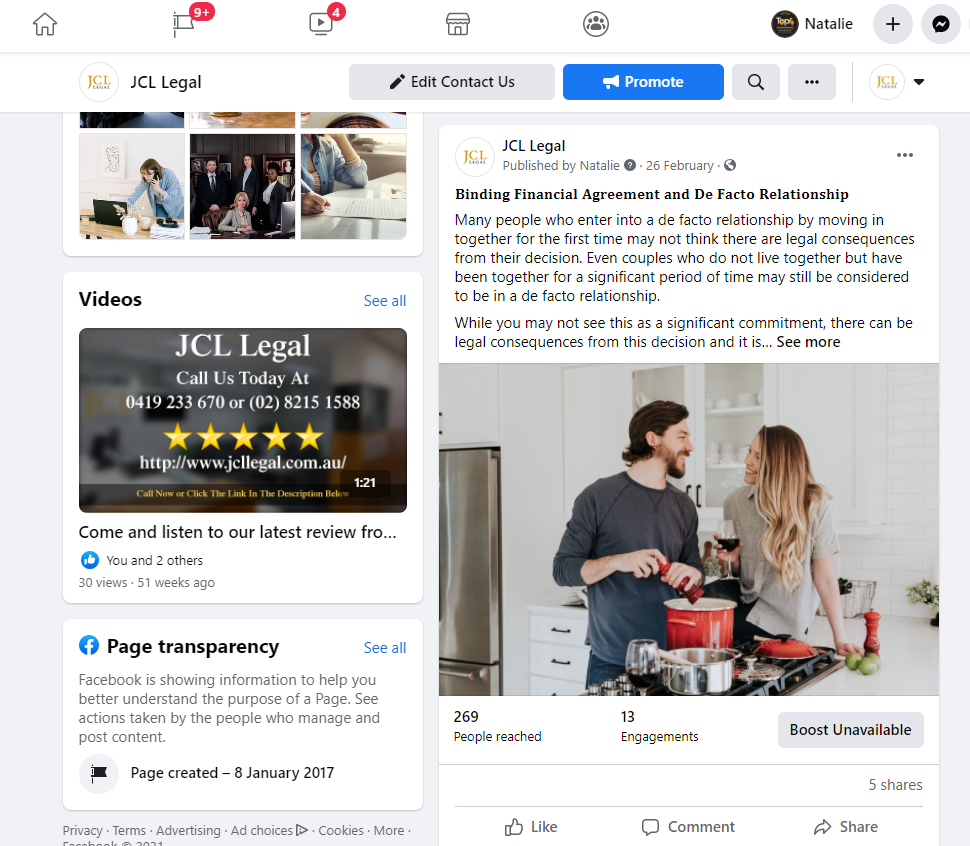

And rounding out the big three in terms of social media platforms, Rudin said Twitter “is the least strong from a lead generation standpoint.”

“I love Twitter because it’s a great news source, and as an adviser you can connect with other professionals and get some great content,” she said. “But it’s a community of peers and less about client acquisition because things start to look really commercial if you’re promoting yourself as an adviser on Twitter.”

Ultimately, she added, whichever platform an adviser prefers, it is important to be active and authentic.

“Being authentic is never a compliance violation,” Rudin said. “There’s a completely different referral process happening right now. People will vet you before they have met you. That means having personal pictures of your family, your passion projects, sports, or other things that are important to you. People want to connect with people, and they want to connect with an adviser that understands them. The more you reveal about yourself, the more people can get to know you.”

To find out how we can help you with your Website + Marketing, using our unique location marketing platform called Top4, get in touch today www.top4marketing.com.au

Looking to build customer loyalty through social media? Don’t forget to add your business to Top4.com.au

List your business, create your own digital store to sell goods and services, and share posts on social media. Promote your business on Google instantly! Should you need help with local digital marketing then view our new Google Marketing Platform and services Top4 Marketing

Get Found On Google Promote Your Website, Reach local customers today!

Our Digital Marketing Agency Services Across All Industries Include Search Engine Optimisation (SEO), Google Marketing, Website Design, Corporate Web Development, and local location-based marketing using our own Google Marketing Platform!

Engage A Social Media Agency For Only 1/3 The Cost Of Employing A Social Media Manager…LET’S TALK!

Source: investmentnews