INDONESIA, TECHNOLOGY AND MSMES

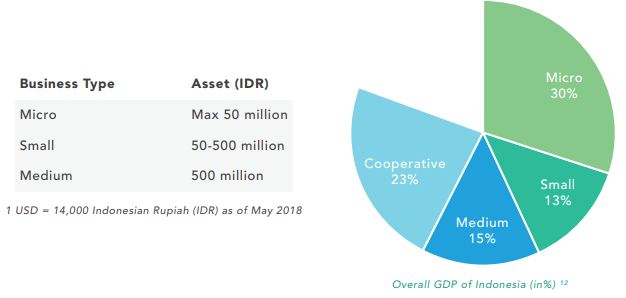

Micro and small and medium enterprises (MSMEs) account for around 99 per cent of existing business enterprises in Indonesia and employ more than 95 per cent of the total workforce across the country. These businesses should be the primary engines of economic growth. But they generate only around 56 per cent of the GDP in Indonesia.

The United Nations defines a micro-enterprise as having fewer than 10 employees; small businesses as having fewer than 50 employees; and medium-sized businesses, fewer than 250 employees. In Indonesia, the majority of businesses are micro enterprises.

Indonesian MSMEs historically have been excluded from regional and global value chains — and even marginalized within local markets — due to a lack of connectivity with markets, access to finance and knowledge networks and a dearth of human capital (the right skill sets), particularly when it comes to the fundamentals of starting and running a successful digital business.

Today, the harnessing of digital technology combined with proactive policy-making has the potential to empower MSMEs and “level them up” into new value chains. Policy-makers in Jakarta and stakeholders throughout the country have recognized this.

In 2016, Indonesian President Joko Widodo launched a technology development plan to make Indonesia the largest digital economy in Asia by 2020, with a target of US$130 billion in digital revenues. As part of this initiative, the Gerakan Nasional 1000 Start-up Digital Initiative was launched and has made tremendous progress. Investment in Indonesian start-ups in 2016 reached US$1.4 billion and then jumped to US$3 Billion in the first eight months of 2017.

In 2017, Indonesia’s Commission for the Supervision of Business Competition (KPPU) issued a report that concluded that 3.7 million new jobs would be created within the digital economy by 2025 and that MSMEs could leverage technology to achieve an 80 per cent increase in revenue growth.

Technology is creating new opportunities and lowering barriers to entry for MSMEs. The digital platform economy is enabling the development of human capital by connecting small enterprises to the digital global commons. This means access to new markets and resources such as cloud-based tools,

e-commerce platforms, and mobile apps that can facilitate an infinite amount of economic and social activities.

According to Statistica, smart phone penetration in Indonesia has reached 43.2 per cent of its population and is rising rapidly. Indonesians spend an average of eight hours and 51 minutes per day on the Internet and the country is currently ranked fourth in the world in this category, behind Thailand, the Philippines and Brazil.

In this regard, digital technology should be regarded as a power multiplier or a “levelling up” mechanism for MSMEs. This should be viewed positively by policy-makers, particularly as governments in emerging markets are striving to embrace strategies that create an environment of “inclusive capitalism” for small business owners.

Digital mobile technology is fuelling growth of the informal economy which presents regulatory challenges to Indonesian policy-makers as well as depriving the government of valuable tax revenues.

According to a report by the Foundation for Economic Education, as much as 60 per cent of Indonesia’s economy is already in the informal sector.

There are caveats associated with these new technologies, primarily when it comes to the role that large platform companies play in the growth of the digital economy. Facebook, Twitter, YouTube, and Instagram, for example, have an overwhelming — some would say oligopolistic — presence in Indonesia and these firms have been accused of crowding out local players.

Large foreign tech companies have been investing heavily in Indonesia’s digital landscape. For example, Tokopedia, one of Indonesia’s largest e-commerce platforms, recently secured US$1.1 billion from China’s Alibaba investor group . Similarly, Go-Jek, Indonesia’s first unicorn — a privately held start-up company valued at more than US$1 billion — has been rapidly diversifying its revenue stream from ride-sharing to digital payment and last mile logistics apps and has relied on Chinese tech giants Tencent Holdings Ltd. and JD.com Inc. to secure crucial funding. Most recently, Google, Singapore’s Temasek Holdings and China’s Meituan Dainping teamed up for a $1.2-billion fundraising campaign on behalf of Go-jek, which also included investment firms KKR and Warburg Pincus.

The presence of the world’s largest tech firms in Indonesia’s digital economy present both tremendous opportunities and challenges for Indonesian MSMEs. Indonesia’s policy-makers will have to strike a balance between embracing foreign investment, while at the same time creating a business environment that nurtures the development of local firms in a fair and open digital market place.

But the challenges posed by large foreign tech giants in Indonesia’s emerging digital economy is not the focus of this report. That is a topic that needs to be addressed in a separate study.

The focus of this report is the positive impact that technology can play to integrate MSMEs into markets, and, most importantly, how to develop and promote human capital through training programs and partnerships to maximize the economic participation of MSMEs in local, regional, and even global value chains.

REPORT OBJECTIVES AND FOCUS

This report explores how MSMEs in Indonesia can leverage technology to better access the digital economy and grow their businesses. A fundamental question to be answered is: How best to develop skill sets and resources so MSME business owners can achieve this goal?

This study is divided into four key sections: first, a brief snapshot of the digital landscape in Indonesia and what kinds of technologies are driving change for MSMEs; a brief literature review and comparison of salient reports and analysis on this subject; a section on general findings and discoveries, and, finally, a section on recommendations for policy-makers.

Key Questions

This report seeks to answer the following questions:

- What does the rapidly evolving digital landscape look like in Indonesia?

- How do cloud-based artificial intelligence (AI), analytics, e-commerce, social media and the sharing economy create economic opportunities for MSMEs?

- How best to harness the above to provide critical training and support to Indonesian MSMEs?

- What are the key challenges MSMEs face when it comes to gaining access to, and participating in these dynamic digital ecosystems?

- What are the key recommendations for Indonesian policy-makers regarding how to support and nurture MSMEs, particularly regarding training, skills development, knowledge sharing, collaborative networking, and strong framework of rules?

- How can policy-makers promote MSME training programs that create inclusive growth along with environmentally sustainable practices?

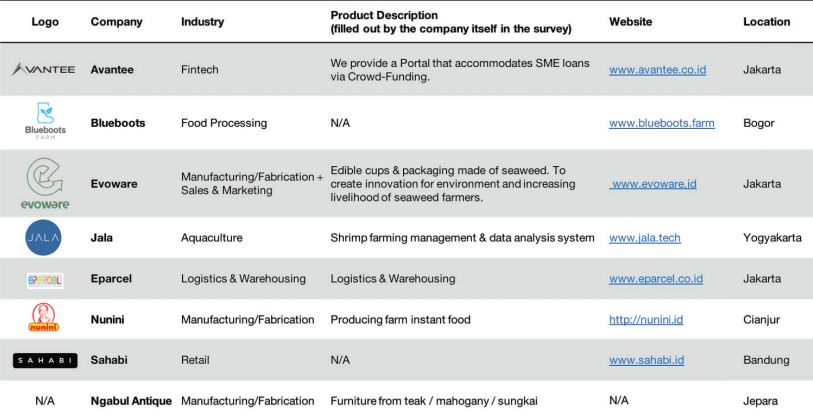

In an attempt to answer the above questions, the author identified and worked with eight Indonesian MSMEs — each serving as an individual case study — and was able to identify common themes that coincide with key findings from previous studies referenced throughout this report. Interactions with the above eight MSMEs prompted many of the author’s recommendations for policy-makers, business leaders, NGOs, MSMEs, and other key stakeholders, which can be found later in the report.

As a rule, the information gathered in this project is intended to serve as the basis for further discussion and policy formulation, specifically regarding the task of developing human capital for further MSME empowerment in the digital sector.

Snapshot of Indonesian MSMEs

About 57 million MSMEs were operating in Indonesia in 2017. About 97 per cent of the total workforce is currently employed in MSMEs, while 99.9 per cent of all businesses in Indonesia are MSMEs. MSMEs account for approximately 60 per cent of the overall GDP of Indonesia.

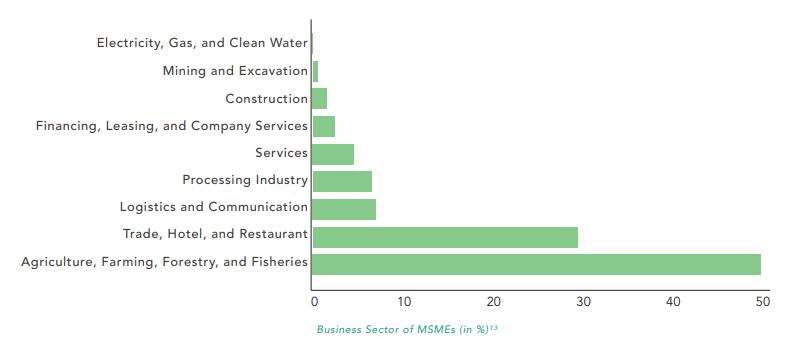

Eighty per cent of MSMEs are in the trading sector and or not engaged in the manufacturing or fabrication of products (instead, they are involved in the buying and-selling of existing products/services). This report focuses on a small cross-section of MSMEs that provide both services the processing and fabrication of tangible goods.

KEY TECHNOLOGIES EMPOWERING MSMEs

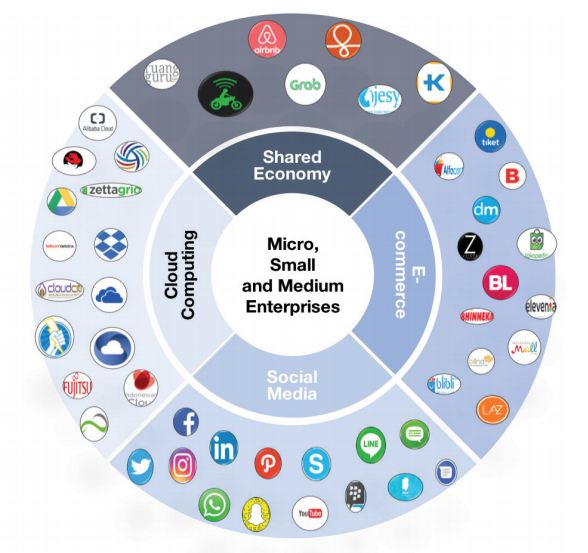

In 2017, more than 60 per cent of Indonesian of MSMEs were online. According to McKinsey, the global consultancy, Indonesia’s trajectory in the digital landscape is very similar to China’s from 2010 to 2015, particularly in the e-commerce space. Four powerful forces have emerged in the digital landscape in Indonesia. They are the springboard for the technological leapfrog that is transforming Indonesia and other emerging markets. The four foundations are:

• Cloud-based tools and computing

• Social media platform and apps

• E-commerce platforms and apps

• Sharing economy platform and apps

These digital ecosystems require robust digital infrastructure to support highspeed broadband wireless access to the internet. Indonesia, an archipelago of more than 17,000 islands, has seen uneven development of its digital infrastructure because of the challenges posed by its unique geography. However, as the internet of things (IoT) becomes ubiquitous, mobile technology will become an exponential power multiplier for MSMEs, even beyond the major population centres of Jakarta, Surabaya and Denpasar as 5G networks are built throughout the country. The national government has committed to rolling out 5G networks over the next three to five years.

Cloud Computing

Cloud computing enables businesses to leverage resources and higher-level services immediately, and in real time, without building up computing infrastructure inhouse. Via a digital platform, MSMEs can access search engines, computing tools, templates, critical algorithms and data analytics applications — as long as they have access to a network. For MSMEs, this means that cloud-based platforms for basic business management — from balancing accounts payable and receivable to inventory management and invoicing — can be done inexpensively or even free, simply by accessing an online tool. The ability to access virtually any kind of information, service or collaborative network at little or no cost is a paradigm shift for MSMEs. The critical issue, therefore, is to ensure that small business owners not only have reliable and affordable access to the cloud, but that they possess the basic knowledge and technical skills to put newly accessed tools and resources to work for the business.

Social Media

Social media enable users to interact with each other on digital platforms that are designed for community-based input, interaction, content-sharing, and collaboration. In Indonesia and other emerging markets, social media platforms serve as conduits for commercial activities with far greater frequency than in more mature markets. Using global platforms such as Facebook, WhatsApp, YouTube, Instagram, Line, and Twitter, for example, provides MSMEs with real-time access to billions of customers, collaborators, suppliers, and other service providers on a scale unimaginable a decade ago. In 2017, social media platforms enabled more than US$3 billion in informal buying —called social commerce — in Indonesia.

E-Commerce

E-commerce describes all transactions made in the digital space on platforms that connect buyers, sellers, and other service providers. In Indonesia, these include local e-commerce platforms such as Bukalapak, Tokopedia and Traveloka, in addition to the big players such as Amazon. E-commerce platforms are micro-economies and also connect extensively to social media networks in Indonesia. At the heart of any e-commerce ecosystem is a digital wallet or payment system that is trustworthy and simple to use. The increasing use of the blockchain is also serving as a catalyst for micro-commerce. Bukalapak recently released an e-wallet called BukaDompet (with funding from China’s Ant Financial and Emtek, an Indonesian media-tech conglomerate) to compete with Go-jek’s digital wallet Paylater.

Sharing Economy

The sharing economy is an economic model that is based on collaborative sharing and using of products and services. Sometimes referred to as the “informal economy,” this type of digital ecosystem allows those with excess capacity to connect those with who need a product or service. In Indonesia, the sharing economy is revolutionizing new micro-markets beyond ride-sharing. For MSMEs, the sharing economy can eliminate costs for expensive equipment, tooling, real estate, vehicles, and other items, and allow for flexible, scalable “asset light” business models.

TECHNOLOGY LANDSCAPE

Here are some examples of platforms and apps serving MSMEs in the digital landscape of Indonesia. They serve as power multipliers for MSMEs and deliver access to global value chains, strategic partnerships, collaborative networks, and customers. They are portals to unlimited knowledge and information.

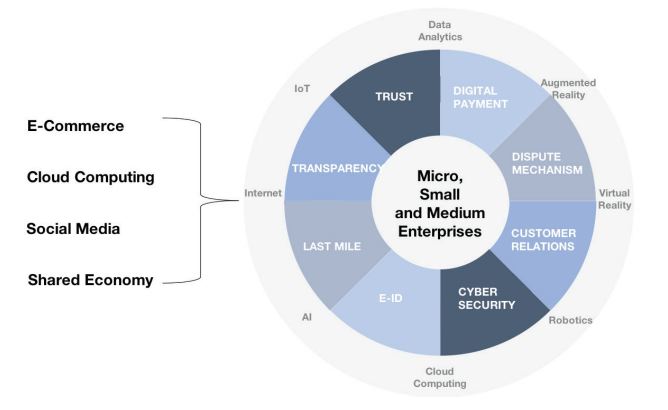

MSME SUCCESS DRIVERS AND CRITICAL TECHNOLOGY

MSMEs depend upon a combination of factors to succeed in the four key environments of a digital landscape:

1. MSMEs need access to technologies such as the internet, cloud computing, and artificial intelligence

2. MSMEs need policy-makers to ensure an adequate framework of rules and business environments that provide transparency, trust, security, and reliability.

MAIN BODY OF RESEARCH AND GENERAL NARRATIVE

This report identified a substantial number of studies which focused on the topic of MSMEs, technology, and opportunities for economic growth in emerging markets. Some of the world’s most reputable international institutions have published extensive reports on both the opportunities and challenges that exist in the quest to empower MSMEs within value chains. Private-sector firms have also published insightful studies on the topic. There are strengths and weaknesses with these studies as they pertain to Indonesia. A literature review of studies conducted by public institutions such as the World Bank, the United Nations, OECD, the World Economic Forum, APEC, the World Trade Organization, the Asia Development Bank, and others reveals a universal narrative with the following strengths:

Public Institution Literature — Strengths

• Recent published studies illustrate how MSMEs are the key to unlocking the next wave of growth in local, regional and, thus, the global economy

• A number of studies focus on why technology is a “game-changer” that provides MSMEs with new opportunities to access markets, knowledge, and tools21

• Other studies have focused on how MSMEs have the potential to grow the next generation of small businesses in an ethically responsible, environmentally sustainable manner. This perspective recognizes gender equality as an integral part MSME growth22.

A broad literature review also reveals that there are universally perceived challenges to unlocking the potential of MSMEs:

• Existing literature captures how poor infrastructure and lack of access to broadband internet have marginalized populations in terms of inclusive growth

• Published sources have focused on how MSMEs can overcome limited access to information, funding, training, and other capacity-building resources

• Similarly, over-regulation, lack of regulatory harmonization, lack of transparency and, for cross-border commerce, the prevalence of tariff and non-tariff barriers have severely stunted growth opportunities for MSMEs in Indonesia and across emerging markets

Business Sector Publications — Strengths

Studies generated by professional consultancies and other private enterprises have focused on the digital landscape facing MSMEs in emerging markets in Asia. In the following ways:

• The technical aspects of digital infrastructure regarding broadband and wireless speed, access and costs

• Specifics of data privacy, security issues and trust27

• Availability of functional digital payment platforms, digital wallets, and mobile financial services such as micro-finance and micro insurance

Weaknesses in the Existing Body of Literature

While the existing body of work provides a comprehensive narrative that captures salient digital opportunities and challenges facing MSMEs in developing markets, the following topics are not sufficiently addressed:

• The best way to provide training and support to Indonesian MSMEs regarding the critical aspects of upskilling and the digital levelling up process required in Indonesia

• Identifying the key challenges facing MSMEs in Indonesia when it comes to gaining access to and participating in dynamic training and learning ecosystems

• Making key recommendations for Indonesian policy-makers regarding how to support and nurture MSMEs regarding training, skills development, knowledge sharing, collaborative networking. This report, therefore, is focuses primarily on the above areas that have not been sufficiently addressed in the existing body of literature.

GENERAL APPROACH

This report draws upon a variety of research methods to obtain its findings, recommendations and conclusions. These include:

• Eight Case studies, which incorporated questionnaires that targeted specific MSME owners and entrepreneurs in Indonesia. The management at these eight MSMEs answered an informal survey and engaged in discussions about the key digital issues impacting their businesses

• Discussions with Ms. Elvira Rosa Hadiningtyas, senior representative at the Ministry of Cooperatives and SMEs, Republic of Indonesia. This government body works closely with Indonesia’s Ministry of Industry, Ministry of Trade, and the Ministry of Cooperatives (Dekopin), as well as a host of other regional and local governmental offices responsible for mentoring and supporting MSMEs. All of these policy-executing bodies report to Indonesia’s Coordinating Ministry for Economic Affairs

• Analysis of public data from bodies including the World Bank, APEC, ASEAN, and the World Economic Forum

• Secondary research from published bodies of work, all of which are mentioned in this report’s literature review section and listed throughout the report’s footnotes and endnotes in the appendix

• Discussions with academic colleagues, such as Dr. Lawrence Low, associate professor and director at the Centre for Governance and International Organizations (CGIO), National University of Singapore. Prof. Low and the CGIO conduct research on ethical capitalism and good governance with a focus on Indonesia and Southeast Asia

• The author’s discussions with MSMEs and policy-makers at a workshop, entitled “Harnessing Industry 4.0 for SMEs Participating in the Digital Economy.” This three-day workshop, directed by the report’s author, was sponsored by Singapore’s Ministry of Foreign Affairs in partnership with Google and brought together policy-makers and MSME owners from Indonesia and across ASEAN. This formed an important frame of reference for the author’s ongoing research

• Discussion with Mr. Graham Dixie, formerly of the World Bank and now director of the NGO Grow Asia, shared valuable insights on efforts to teach smallholder farmers in Indonesia how to successfully leverage mobile technology.

• Interviews with managers of NGOs in Indonesia, namely, Mr. Michael O’Leary, director of the ROLE Foundation in Bali.

MSME CASE STUDIES AND INTERVIEWS

List of MSME Case Studies

A total of eight MSMEs agreed to be the subjects of case studies and to engage in discussions regarding the state of technology and how it impacts their companies in Indonesia. They also shared their views about training opportunities available to them. These case studies were not intended to represent a statistically significant sample, but rather to provide anecdotal evidence that supports broader trends which were identified in another 2018 survey of 448 Indonesian entrepreneurs and MSMEs, conducted by Canada’s Asia Pacific Foundation.

CASE STUDY FINDINGS AND DISCOVERIES

Company Operations

The eight MSMEs that participated in this report’s case studies have been in business for an average of 6.5 years and earn an approximate monthly gross revenue of US$7,297.

Digital Awareness

All eight companies believe they are just managing to keep up with digital tech, but that they are lagging behind in key areas, particularly employee training.

Digital Infrastructure

The majority of companies were not aware that there is assistance available from government entities, NGOs, and private companies to improve their internet infrastructure, e-commerce, and digital business activities. The primary technology platforms used for the companies’ operations are mobile applications.

Funding and Financial Support

Half of the companies questioned stated that they are using digital technology poorly to obtain financing and funding. The biggest challenge to raising money and getting financial support involves a lack of trust and a general lack information about where and how to obtain funding.

Regulatory Environment

The biggest challenges in Indonesia’s regulatory and legal frameworks involves a lack of information about relevant regulations (for compliance purposes) as well as the lack of harmonization and coordination between government agencies.

Cross-Border Digital Readiness

For opportunities regarding cross-border business, all of the eight case study MSMEs rely on existing e-commerce platforms like Tokopedia or use a combination of social media and traditional postal and express consignment companies such as FedEx, DHL, or UPS.

Data Pooling, Collecting and Sharing

Managers from all companies stated that they would welcome free access to government data if it was useful to their businesses.

Training and Access to Knowledge

MSMEs perceive government-funded scholarships and business-sector-specific workshops as the most valuable training opportunities, specifically, to learn business management and technical skills. More publicly available information about the availability of training and upskilling opportunities would be appreciated.

CASE STUDIES: DIGITAL TECH USED TO GROW MSME BUSINESSES

Representation of the types of technologies used by the eight different companies participating in the case studies.

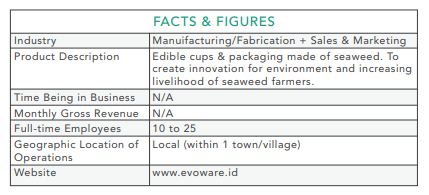

MSME CASE STUDY SNAPSHOT – EVOWARE

Evoware is a socially responsible enterprise that provides sustainable eco-solutions for plastic waste problems in Indonesia. The company’s products — which include cups, bowls, wrapping materials, packaging, and coffee and tea satchels — are ecofriendly and biodegradable. They are made from natural seaweed. All of Evoware’s products have a two-year shelf life and are printable, sealable and EDIBLE!

Technology Used

Evoware uses cloud-based computing and tools, social media apps, data analytics platforms and tools, sharing economy apps, digital wallets, blogs, and open-source communities.

Challenges

Evoware faces challenges when it comes to educating its employees about digital trends and business opportunities. Management perceives the business as moderately enabled in digital business capabilities. The enterprise is lagging in key areas. Evoware would like to expand its digital business and e-commerce across borders. Challenges involve the regulatory environment and a lack of information about legal frameworks and regulations. Harmonization and coordination between government agencies is lacking. Access to broadband wireless internet services is not available everywhere when it’s needed. Evoware believes that the government is not doing enough to invest in digital infrastructure in their area and is not providing access to training and education.

Needs

Improve the general digital business capabilities and knowledge of existing employees. Be up-to-speed about the newest digital trends and business opportunities. Employees need access to technical training and better access to general business knowledge. The need for more information and instructions about legal frameworks and regulations is urgent. Regulatory updates are seen as very helpful. Evoware also requires funding for training and human capital development.

GENERAL RECOMMENDATIONS

MSMEs are making progress in Indonesia towards inclusive, sustainable and scalable growth. But, in an archipelago nation of more than 17,000 islands, this progress has been unevenly distributed. Most progress has been concentrated in the urban clusters on the Islands of Java and Bali, namely, Jakarta, Bandung, Surabaya and Denpasar. For an MSME to leverage technology in four key areas of the digital landscape (e-commerce, the sharing economy, social media, and cloud-based analytics or AI), governments must play a proactive role in enabling the right kind of business ecosystems and public private partnerships. The Ministry of Cooperatives and SMES, the Ministry of Trade and the Indonesian Cooperation Council (DEKOPIN) have been engaged in ongoing efforts to create an environment of digital inclusion for MSMEs. These efforts are to be commended. The recommendations in this report, therefore, are intended to complement these ongoing efforts. Recommendations focus on systemic challenges regarding digital infrastructure as well as more granular areas of policy-making concerning human capital development for MSMEs. More generally, on the matter of good governance, the underlying message that has emerged from MSMES in this study, as well as the previously cited existing body of literature, is that government agencies and policy-makers in Indonesia must continue to improve how they interact with MSMEs in the following ways:

• Making information for MSMEs ubiquitous and easy to access

• Simplifying and harmonizing rules for doing business

• Being a trustworthy and reliable collaborator in multi-stakeholder ecosystems

• Providing for increased transparency and access to government-generated data

• Embracing bottom-up open-sourced solutions and collaboration

• Promoting public-private partnerships on local, regional, and even global levels

• Improving coordination between government agencies and national, regional. and local government offices.

DIGITAL INFRASTRUCTURE

Everything begins with digital infrastructure. A prime opportunity is in the offing for Indonesia to achieve a leapfrog in technology from existing 3G and 4G wireless networks to fifth generation (5G) technology. 5G technology, which is lightning fast and has vastly more bandwidth than 3G or 4G wireless, is the key to achieving growth in a world that will be driven by billions of mobile smart devices on the internet-of-things (IoT). According to the wireless technology giant Qualcomm, the global 5G economy will be valued at about US$12.3 trillion in revenue by 2035. 5G is particularly promising for an emerging market like Indonesia and should empower MSMEs. Discussions with the Ministry of Cooperatives and MSMEs revealed that the lack of internet connections throughout less- developed areas of Indonesia continue to pose challenges for MSMEs. As such, Indonesian policy-makers must double down on their efforts to accelerate capacity building around the adoption of 5G wireless. To accelerate 5G development, the Indonesian government, telecom operators, and other key stakeholders will need to form strategic partnerships with foreign technology companies. While this is necessary, this could become complicated as Indonesian policy-makers are concerned about over-reliance on foreign firms and governments.

TRAINING AND HUMAN CAPITAL DEVELOPMENT

Operating a business in the digital economy requires basic skill sets. Below are key areas demanding priority policy attention and ongoing support.

Basic Business Skills Education

Even before MSMEs avail themselves of the four key areas of the digital economy, business owners must first possess basic knowledge and skills regarding how to manage a business. The Ministry for Cooperatives and SMEs has slotted four specific areas for basic skills training:

• Cooperative management training

• Growth and development of entrepreneurship

• Capacity building in specific sectors (tour guides, for example)

• Special training for disabled workers and ex-migrants.

This is progress, but the next step requires significant scaling up to make more training available to a broader audience regarding the fundamentals of managing a business. This should include basic topics on finances, procurement and sales, and inventory management. This training should feature the following attributes:

• Hands-on learning

• More diverse classes designed for a broad range of business sectors and niches

• More locally based face-to-face courses

• More courses that are free of charge or subsidized by government, local business groups, associations or NGOs.

A successful example of one such training organization is the Bali-based ROLE Foundation which provides basic skills training combined with awareness of environmental sustainability. ROLE works closely with local government in Bali delivering programs designed to equip women with skills for ongoing wageearning opportunities.

Collaborative Public-Private Ecosystems

Some of the best government sources for expertise and valuable human capital reside outside of governmental institutions. Rather than pursuing top-down, hierarchical initiatives, policy-makers should seek collaborative partnerships with relevant stakeholders, including local business owners, multinational enterprises, local government officials, NGOs, and other community organizations. The Ministry of Cooperatives and SMEs has entered into some ground-breaking public-private partnerships aimed at assisting MSMEs. These include:

• Partnering with e-commerce platform Lazada, to curate ready-to-export products for MSMEs

• Working with e-commerce platform Bukalapak, to showcase 2 million MSMEs and their products

• Collaborating with PT. POS Indonesia to build MSME distribution networks

• Working with Blibli.com to promote and showcase MSME products in Gallery Indonesia WOW

• Teaming up with Pasar Induk Nusantara (PIN) to improve agricultural supply chains for MSMEs.

These are all excellent initiatives. Again, these efforts should be scaled up so new on-line partners can join nascent ecosystems. The benefits of more public-private training initiatives will include:

• Open-sourcing of ideas and solutions

• Avoidance of one-dimensional, short-sighted perspectives

• Bottom-up and lateral input from key stakeholders

• Accountability and cost-sharing amongst key stakeholders

• Transparency, trust and relationship building opportunities.

The role of the Ministry of Cooperatives and SMEs in these partnerships should include a combination of facilitation, regulatory enforcement, and leadership around capacity building. But there is also a caveat: policy-makers must not grow overly dependent on the large e-commerce platforms. It is important to foster innovation on a local scale, without conceding autonomy to large platforms — particularly if those platforms will own all the data of local MSMEs.

On-line Platforms and Mobile Apps

MSMEs require fast and easy access to information regarding training and skills acquisition. One area that has seen a surge in activity is the development of online courses and learning apps. Indonesia’s national, regional, and local governmental institutions need to increase the amount of access to online educational resources regarding business management and digital skills. These platforms and apps can include:

• Short three-to five-minute micro-courses on skills-related topics

• Crowd-sourced apps that allow anyone to create new learning content

• Resources from trade schools, universities, NGOs, and other on-line sources

• Bespoke online courses developed through public-private partnerships

• Partnerships with social media platforms to promote and deliver learning apps and links.

One example of a powerful mobile micro-learning app that enables the creation of crowd-sourced educational topics is gnowbe.com. Indonesia’s MSMEs will benefit greatly from a wave of new educational topics on micro-learning apps. Another example in Indonesia is ruangguru.com which provides a “digital boot camp,” an excellent platform for MSMEs to learn basic skills.

MSME FUNDING AND FINANCING

Lack of access to basic funding remains a major challenge for MSMEs in Indonesia. When it comes to providing grants or scholarships for upskilling, policy-makers need help from key stakeholders, including banks, NGOs, venture capital firms, start-up funds, and industry associations. In Indonesia, about half the adult population has no actual bank account. There have been recent initiatives to change this. Bank Rakyat Indonesia, the nation’s second largest bank, as well as Bank Tabungan Pensiunan Nasional, have been working with the Indonesian government to set up mechanisms for getting micro-loans to qualified MSMEs. Meanwhile, Bank Mandiri has been accepting micro-loan applications via post offices throughout Indonesia.

Micro-Loans and Mobile Financial Services

Policy-makers in Indonesia have been struggling to enforce effective regulatory frameworks regarding micro-financing — particularly in remote parts of the archipelago where income levels are extremely low. Consequently, unscrupulous lenders and loan-sharking have thwarted the development of a legitimate, wellmonitored micro-lending landscape. Lack of trust abounds. The Ministry of Cooperatives and SMES is working with banks to tackle these challenges. Two major benchmarks for achieving a functional micro-loan environment in Indonesia involve accountability and traceability. The Ministry of Cooperatives and SMEs has been working with banks and other financial institutions to address accountability and traceability needs by:

• Developing Integrated Business Service Centers (PLUT-Pusat Layanan Usaha Terpadu) to consolidate administrative and support functions for financing and tracing micro-loans, training programs and other services for MSMEs

• Establishing a cooperative online data base with identification numbers (Nomor Induk Koperasi — NIK) for all MSMES and linking these to NIK certificates regarding credit-worthiness and other criteria

• Linking the above to general, online micro-business permits (IUMK).

These are all encouraging developments, but there are challenges. Creating the technological infrastructure around these online frameworks have revealed that there is a shortage of resources, including a lack of expertise in both the Indonesian civil service and at Indonesian financial institutions.

Therefore, policy-makers are encouraged to focus on:

• Increasing mobile device penetration and infrastructure

• Supporting existing and nascent e-commerce platforms with the rollout of digital wallets34

• Engaging outside subject-matter expertise and professional services firms around capacity-building efforts

• Building trust by increasing dispute resolution and enforcement mechanisms.

Access to Low-Interest Loans and Grants

The following media and organizations can help policy-makers communicate with MSMEs and raise awareness regarding access to funding opportunities:

• Social media platforms

• Traditional media, including TV

• Crowdfunding applications (with banks as lending partners)

• Universities and trade schools

• NGOs

• Venture capital firms

• Business incubators and accelerators

As described earlier, policy-makers can incentivize banks and other financial intermediaries to participate in such ventures, by continuing to build the relevant databases (NIK), installing credit mechanisms and integrating service centres (PLUT) to connect MSMEs to more platforms, companies, and collaborative networks. This will involve incentives, but because of increased traceability and accountability the government will be able to better enforce regulations and standards. In order to prevent corruption and mismanagement, policy-makers will need to focus on good governance: transparency, traceability and accountability. Independent third parties will need to be contracted to audit results and measure performance.

EMPOWERING WOMEN IN THE INDONESIAN WORKFORCE

Inclusive digital growth, in any market, means that women need to actively participate in the economy. In Indonesia, as in much of the emerging economies of APEC, women continue to be under-represented in employment numbers and continue to face an uphill struggle when it comes to competing for jobs, business, training and, in general, equal opportunities with men. While gender issues are not intended to be the core focus of this study, it should be pointed out that the digital economy offers unprecedented opportunities for women in Indonesia. One of the reasons for this is that digital wealth creation is gender-agnostic. A customer buying a product on an e-commerce platform, or consuming information on a cloud-based app, does not know if the app or platform was designed by a man or a woman. The consumer of an on-line service, of any kind, generally would not care who owned the IP or who created the content. As such, women in Indonesia will need to be equipped to compete and succeed in the digital landscape. Policy-makers will have to be proactive in making this happen. The Asian Development Bank, in its Indonesia Country Report, cites some progress in this area36. But for women to further boost the digital economy in Indonesia (in both the formal and informal economic sectors) policy-makers are encouraged to increase efforts to partner with key stakeholders to promote:

• Digital literacy programs for girls, starting in primary schools

• Equal opportunity laws and employment programs targeting female students and employees

• Collaborative partnerships with NGOs, businesses, academic institutions and governments that provide women with digital upskilling opportunities

• Funding for women-owned businesses.

One success story regarding increased opportunities for women in Indonesia involves a venture capital firm called Angel Investment Network Indonesia (ANGIN)37. Of the almost 3,000 projects that ANGIN has reviewed, they have facilitated more than 40 projects and funded more than 30 — many have benefited women-owned or women-run businesses. The ANGIN success story of leveraging digital technology to build an entrepreneurial ecosystem that efficiently matches investors with recipients — on an equal-opportunity basis — needs to be expanded. Indonesian policy-makers should encourage more entities to use the ANGIN business model.

PROMOTING ENVIRONMENTALLY SUSTAINABLE BUSINESSES

Indonesia, like other emerging economies, must contend with the challenges of habitat degradation, plastic waste, global warming, and a host of other environmental issues. Policy-makers must adopt forward-looking policies that mandate sustainable business practices and that provide MSMEs with the tools and training to achieve sustainable growth at the grass-roots level. Policy-makers should double down on efforts to get MSMEs to embrace sustainable business models. Below are some ideas:

• Funding and grants based on sustainability benchmarks and best-practices

• Sustainability training programs; • Collaborative ecosystems around “circular economies”

• Crowd-sourcing of apps and platforms that facilitate sustainable practices

• Partnering with world-class NGOs and thought-leadership institutions.

For example, GrowAsia.org is an NGO that has been partnering successfully with local governments and MSMEs in the area of sustainable agriculture. The Grow Asia Partnership for Indonesia’s Sustainable Agriculture (PISAgro) seeks to provide an innovative, multi-stakeholder model for addressing the nation’s agricultural challenges in a sustainable manner while improving the livelihoods of smallholder farmers. Grow Asia supports 12 working groups focused on 11 crops and commodities. Grow Asia has been successful in empowering farmers with access to mobile apps and platforms, which enables them to leverage critical real-time data, collaborative networks, micro-finance, micro-insurance, and other technologies.

CONCLUSION

The digital economy has afforded Indonesia’s MSMEs unprecedented opportunities for inclusive growth within local, regional, and even global value chains. E-commerce, social media, the sharing economy, and cloud-based analytics/AI are all contributing to an MSME technological leapfrog. But as this report has revealed, Indonesia’s MSMEs face numerous challenges when it comes to successfully participating in the digital economy. Among other things, business owners need improved access to all manner of digital literacy resources, including general information and basic business education, industryspecific training and human capital development, funding, and, of course, more online access. A common theme that has emerged from this study is the power of collaborative networks operating in digital ecosystems. In these scenarios, MSMEs can benefit from open-sourced solutions, with key stakeholders contributing to the successful dynamics of entrepreneurial ecosystems. Another theme emerging from this study is that Indonesia’s policy-makers will need to provide effective leadership, not only as facilitators, but as fair and consistent law enforcers and regulators. This view came through very clearly in the responses of the MSMEs that participated in surveys and interviews. More generally, the MSMEs that participated in this study corroborated the same concerns of MSMEs in other studies highlighted earlier in this report. In conclusion, the technology revolution offers great promise for Indonesian MSMEs. But this remains a work in progress, and policy-makers will have to follow a rigorous roadmap to achieve success.

Don’t forget to add your business to https://www.top4.com.au/

List your business, create your own digital store to sell goods and services, and share posts on social media. Promote your business on Google instantly! Should you need help with local digital marketing then view our new Google Marketing Platform and services https://packages.top4.com.au/

Get Found On Google Promote Your Website, Reach local customers today!

Source: Alex Capri